In any business, there are always ways of saving money in your business. It may seem like an impossible task, but with careful planning and execution, you can cut costs without sacrificing quality or service. In this blog post, I will discuss eleven tips to help you save money in your business.

Table of Contents

Saving Money

Some of these tips may be more applicable than others depending on the industry you are in, but we believe that all of them have the potential to help you reduce expenses and improve your bottom line.

Similarly, if you neglect to keep your business healthy, the unchecked corners of your enterprise can become infested with inefficiency. This is when money starts to leak, the dominoes are set in motion. Then before you know it, you can quickly find yourself during frantic damage control.

This is not an article about slick new ‘business tech,’ but an examination of how some modern innovations could make running your business easier and less expensive.

1. Review Your Expenses Regularly and Look for Ways to Reduce or Eliminate Them

One of the best ways to save money in your business is to review your expenses regularly. This will help you identify areas where you may be able to cut costs without sacrificing quality or service.

There may be some necessary expenses, but there are often ways to reduce them.

For example, if you are spending too much on office supplies, you may be able to negotiate better rates with vendors or find cheaper alternatives. If you have employees, it is also important to review their expenses and make sure they are not spending unnecessarily.

You may want to set spending limits for certain types of purchases or require them to get approval before making any large purchases. Regularly reviewing your expenses will help you identify areas where you can save money without affecting your business too much.

I love using an Excel spreadsheet for this and update as each expense is incurred. I also project a few months out to help me better plan for expenses.

2. Make Use of Technology

Technology can be a great way to save money in your business. There are many ways to use technology to automate tasks, communicate with customers and suppliers, and manage your finances.

By using technology wisely, you can save a lot of time and money.

For example, if you have a customer database, you can use it to send automated emails or text messages about special offers or new products. You can also use it to track customer purchases and preferences so that you can target them with relevant offers.

If you have an online store, you can use automation tools to handle inventory management and shipping. There are many other ways to use technology to save money in your business – the possibilities are endless!

Investing in technology can help you save a lot of money in the long run, so it is worth considering if you are looking for ways to cut costs. Do your research and talk to other businesses to find out what technology they are using to save money.

Check out the Right Blogger video below – today they have 91 tools to help not only bloggers but small business owners.

3. Review Your Pricing Strategy For Saving Money in Your Business

If you want to save money in your business, it is important to review your pricing strategy. Make sure that your prices are competitive and that you are not leaving money on the table. It is also important to consider your margins when setting prices.

If your margins are too low, you will struggle to make a profit. On the other hand, if they are too high, you may price yourself out of the market. There is no magic formula for pricing products or services, but there are some general guidelines that you can follow.

Do some research on your competitors’ pricing and try to find a balance that works for you. It is also important to keep an eye on changes in the market and adjust your prices accordingly.

Regularly reviewing your pricing strategy will help you ensure that you are maximizing your profits and not leaving money on the table.

If you are struggling to compete on price, it may be time to rethink your business model. There are many other ways to save money, so do not feel like you have to sacrifice margins to stay competitive.

Take the time to review your pricing strategy and make sure that it is working for your business.

4. Negotiate With Your Suppliers To Save Money

One of the best ways to save money in your business is to negotiate with suppliers. If you have been working with the same suppliers for a while, you are likely paying more than you need to.

By negotiating better terms, you can save a lot of money on supplies and materials. Of course, it is important to make sure that you do not sacrifice quality or service in the process.

But if you take the time to compare prices and find the best deals, you should be able to get what you need at a reasonable price.

It is also worth considering alternatives to traditional suppliers. There may be other businesses that can provide what you need at a lower cost.

Don’t be afraid to negotiate with your suppliers – it could save you a lot of money in the long run.

If you are not happy with the terms that your current suppliers are offering, look for alternatives. There are many other businesses out there that would love to have your business. Take the time to compare prices and find the best deals on supplies and materials.

It could save you a lot of money in the long run.

5. Review Your Insurance Coverage

If you want to save money in your business, it is important to review your insurance coverage. Make sure that you are not paying for coverage that you do not need. You should also make sure that your coverage is adequate and that you are not underinsured.

Many businesses carry insurance policies that are too small or that do not cover the right risks. As a result, they can end up paying a lot of money out of pocket if something goes wrong. To avoid this, it is important to work with an experienced insurance broker who can help you find the right policy for your business.

Don’t wait until something happens to review your insurance coverage. Make sure that you have the right policy in place before you need it. It is important to review your insurance coverage regularly.

Make sure that you are not paying for coverage that you do not need and that your policy is adequate. An experienced insurance broker can help you find the right policy for your business.

Don’t wait until something happens to review your insurance coverage. Make sure that you have the right policy in place before you need it. It could save you a lot of money in the long run!

6. Credit Card, Gas Card, and Insurance Rewards

If you use credit cards, gas cards, or insurance cards for your business expenses, you may be able to get rewards. These rewards can save you money on future purchases or help you earn cash back. For example, business gas card benefits might include discounts on gas, free maintenance, or even cash back.

To take advantage of these rewards, it is important to read the fine print and understand the terms and conditions. Some rewards programs have restrictions or limits that you need to be aware of. But if you use your cards wisely, you can save a lot of money with these programs.

There are many different ways to save money in your business. By following these tips, you can cut costs and improve your bottom line. Investing in energy-efficient equipment, negotiating with suppliers, and reviewing your insurance coverage are all great ways to save money.

So don’t wait – start saving today!

7. Open-Source Software

Purchasing the right software, even basic office software, can be a massive expense for a business. Before you spend hundreds or thousands on that next upgrade, have a look at what’s on offer for free.

Open-Source software is developed on an ethos of sharing, and you’ll find a whole wealth of free downloads to suit your needs.

Just be sure to check them out completely as you often get what you pay for! Starting with open-source software for FREE is a great idea before your upgrade to a paid version.

Furthermore, you can test the software out along the way before making a purchase. I’d done quite a few of those over the years here at Inspire To Thrive. I love testing new ways to save time which often equates to saving money.

8. Sourcing Your Utilities for Saving Money in Your Business

Although this may seem obvious and is something people do at home, but this can be an expense that entrepreneurs often overlook. Did you know entrepreneurs are at least 80% overpaying for at least one utility?

With the availability of comparison websites, there’s no need for this to be happening. Your business gas and electricity, alongside other utilities such as the internet, should always come from a provider that meets your needs at a sensible price.

Oftentimes I have to travel miles to meet with customers and being able to save money on my gas is important. Why has the money gone out the window, right?

On the other side of the equation is internet services. The money I save on gas for the vehicle I invest in the best and fastest internet speed I can buy for the business. You have to decide what you need the most and spend accordingly for your business.

Be Careful not to be Penny Wise, Pound Foolish, Robert Burton

9. Automate the Workload To Save Time and Money

The advance of technology has only accelerated since the Industrial Revolution. The phenomenal changes we’ve witnessed within a couple of short decades suggest that the march of progress will only continue to accelerate in the foreseeable future.

As a business owner, you need to always have the latest intelligence on how this will affect your business and the job roles within it.

Take accountancy, for example. This is a job largely based on coordinating and crunching numbers, making it a prime candidate for automation.

There are already many options online for automating business taxes and monitoring income and expenses. Additionally, there are programs that cut much of the legwork from secretarial roles.

For businesses dealing with sales tax compliance, platforms like Numeral can automate registration, filing, and remittance processes.

You won’t be able to staff your entire business with robots just yet. But, you’ll find that by using technology in the right places you can economize on how many hours staff needs to work, and how many people you hire.

If you have been reading Inspire To Thrive for long you know I’ve been using Agorapulse to automate my social media management. This software has been a lifesaver not just in money but in time!

Not only does this tool help with social media management but now offers social media listening tools. I can also respond to customers within the dashboard. Thus, this tool gives me more ways to save TIME! Remember, time is money too!

10. Advertising Intelligently

This is where technology can trip us up as much as facilitate us; don’t assume that the most modern digital advertising methods are always the greatest. Sometimes digital advertising platforms aren’t always the best use of your money.

Advertising needs creative flair, and while data harvesting can enable us to choose targets better. Therefore, technology can’t substitute human creativity required to make an effective advert.

So keep this in mind when you look at options for advertising your business. Don’t continue to pour money into advertising unless you know the approach is working.

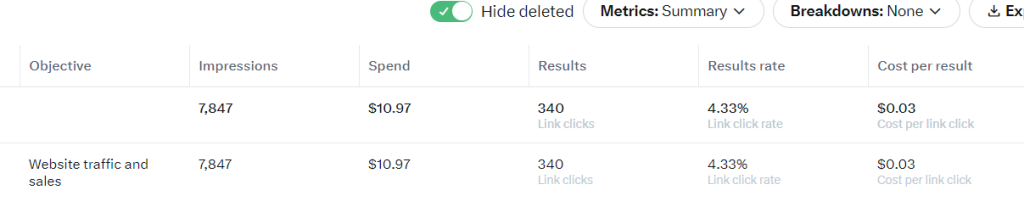

Be ready to always monitor your digital ads, whether they are Twitter X, Facebook ads or Google ads. They are always a work in progress!

The advertising models for digital ads are changing rapidly and you must be always in the know about them to use them effectively.

As you can see below X Twitter delivers more for your money in 2024 than all other social media advertising.

An Advertising Example

For example, if you are in the law firm industry, you’ll want to know about Law Firm Internet Marketing trends. Make sure your law firm targets the right people in its digital campaigns and has a strategy for success. But most importantly, don’t let one single method become too dominant in your advertising mix.

A combination of various approaches will always work better than placing all your eggs in one basket. The need for variation applies to both traditional and digital advertising models. Traditional advertising for law firms is usually in magazines, newspapers, and radio spots.

So next time you consider saving money for your business, don’t forget the right approach to marketing and advertising! Investing some extra time into researching new methods can help save you money in the long run.

11. Monitoring Your Spending

Of course, keeping track of your business expenses is a must today if you want to save money in business. Not only do I keep a spreadsheet of daily and monthly expenses but I look ahead. You can use modern or old fashion methods to monitor this spending. (Whatever way works for you!)

By looking ahead you can see what months have unique expenses like estimated taxes, business insurance, etc. The only time then to can add to your monthly budget is when there are no other unique expenses.

Next, is also keeping track of your business deposits. When these go up you can decide whether to reinvest in your business, save money or make a little more money.

Conclusion: Saving Money in Your Business

Saving money in your business helps you to be able to invest in advertising and marketing. This in turn will help you grow the business further or put more money in your pocket.

How are YOU saving money in your business today?

- What Are Niche Edits and How Do They Help You Build Backlinks? - January 24, 2026

- Image SEO for Bloggers: File Names, Alt Text, and Compression Without Blurry Photos - January 22, 2026

- Designing User-Friendly Websites That Drive Results In 2026 - January 21, 2026

Hi Lisa, learning how to save money while getting things done is a crucial skill for those just starting out and with very low funds.

It takes time to start earning money online and you need to know how to cut corners here and there and still get quality work done.

I, for example, like to take advantage of the gratuitous trials some tools give.

It helps me work and i know that if I like the tool I will return to it and buy a premium version.

So we all win!

Hi Nikola, Yes, being able to try something out for free for a week or a month is a great way to be sure it will be worth your money to invest in it. I’ve learned that it takes either time or money to get things done! You can’t have it all – at least not in the beginning. I also advise people to check their credit card statements and be sure there are no unknown charges. That seems to happen more often than not these days. Thanks for coming by on this one and have a great day Nikola.

Hey Lisa,

These tips are really sounds innovative and have potential minimize expenses, I’m completely agree with you – people are investing more n more money on advertising with the help of digital technologies but sometimes it sucks.

Expense management is hectic task but by applying positive aspects we can cut lots of expense in businesses. Thanks for your innovative ideas.

With best wishes,

Amar Kumar

Thank you Amar. You are right that digital advertising can suck if not done right. I think it may be something a business can outsource to a very trusted source as well. I appreciate your coming by on this and have a great day!

Hey Lisa,

Yes, starting and maintaining a business is skeptical. It’s good to get tips from an experienced person as we are not born with experts on finance.

Some people spend most of their time and energy on earning more, but it is important to remember that without learning the art of spending money well, they may not be able to secure a good future.

Expense management is all about getting the right value for every dollar spent. And Time is money too, especially in businesses.

This post is a sure fire to help cut unnecessary costs.

Thanks,

Jeangam Kahmei

Hi Jeangam, welcome to Inspire To Thrive. Thank you. Yes, I always have said they should teach more finance in the schools starting in elementary school! Too many kids today have no idea how to budget and starting a business is not the time to learn. You are right about those always spending time to earn more but spending a little time on the investments is also key to producing profits. You are most welcome and have a great day and new week.

Hi Lisa,

Your post is ideal since many are struggling to save money. In fact, it becomes even more challenging if you cannot quantify your expenses. As a business owner, you will always invest in your business to help you generate more returns. You should keep your investments in check and save as well.

Hi Moss, indeed, you got that right. And I like that you use the investments. That’s what money in business is, not spending but investing. Thanks for your input and for coming by here Moss! Have a nice day and weekend ahead.

Hi Lisa,

Great stuff. Really, it is something I have been looking for. Saving money while doing business is not that easy. We have to keep investing in many aspects of our business. And for my online business, I just keep track of my spending. After investing in something, I literally analyze how it is bringing value to me. Somehow if it’s not, I just stop investing in that thing. You won’t believe that works like a magic for me and it really helps in savings.

By the way, I have got some amazing savings tips from you that I’m gonna apply for sure.

Thanks for sharing. Keep doing the awesome work.

Hi Jitendra, thank you. Yes, investing is the key word! Many people don’t understand that. It takes some money to make money as they say. I’ve been keeping track as well and repeating what works and deleting what doesn’t. Another point is to remember that TIME is money as well. If something is NOT saving you time, you must re-consider and some of these decisions can be really hard when it comes to people.

You are most welcome Jitendra and I appreciate your taking the time to comment here on Inspire To Thrive.

Hello Lisa,

Saving is a big challenge for businesses. You have to analyze the overall performance of your business and I like your smart advertising techniques. Pumping money without analyzing the advertising source does not make any sense. It will eventually increase your expense. Keeping an Organized accounting is the best way to deal with your expenses. Great Post. Shared On my Social Networks.

Regards,

Vishwajeet

Monitoring spending is simple but oft overlooked Lisa. I doubled down a few months ago on all I spent; offline, online, biz-wise and life-wise. Thinking through how you invest money aids savings in a wonderful way. I dig your tips.

Hi Ryan, Oh yes, one has to do that to make their business survive and then thrive. You can’t always spend but investing wisely in your business is key today. Thanks for coming by on this post today. Enjoy the rest of your day and I hope you are feeling better !