Today, with almost everything being done online do you worry if your money is safe in the cloud? Banking and investing are no different now than online shopping.

Ten years ago, transferring your savings to an online-only bank required a leap of faith. Today, banks with little or no physical presence are more commonplace, but it isn’t unusual for you to wonder how safe your money is in a non-traditional bank.

Many people are using digital wallets today for their Bitcoin and when they buy Ethereum on Paybis or Dogecoin for example.

Is your money really safe in the cloud today?

The answer to that lies less in whether the bank is traditional or next generation. And now, more in how disciplined you are as a user and how disciplined your financial organization’s employees are.

Table of Contents

Next Generation Banking

Consumer demands on banking institutions are more than just consumers wanting online balance checking and bill payment. Consumers want more personalized products and services across multiple interaction channels.

This requires that banks bring products to the market more quickly. This has led to cloud core banking gaining traction and allowing new, technology-driven financial institutions to enter the market. Some of these make it quicker to make purchases online.

Traditional Banking

Traditional banking institutions are feeling pressure from the more agile next-generation banks that can cater more personally to continually changing consumer demands.

These institutions must begin to consider moving away from traditionally stable, reliable, and highly secure infrastructures to more agile and scalable cloud-based core banking.

Have your kids even walked into a bank? My sons are 32 and 34 and have never walked into a bank. They do all their banking online from their mobile devices and apps.

Security Comparison

With next-generation financial institutions operating on cloud cores and traditional institutions moving in that direction, how safe is your money in the cloud?

Traditional financial institutions benefited from custom infrastructures that were heavily penetration tested on a continual basis. The newer cloud-based infrastructures seek to provide that same iron-clad safety for their consumers’ personal and financial data.

API-based functionality coupled with ever-increasing improvements in VPN encryption allows cloud core providers to reduce risk.

While cloud technology is improving, legacy cores of more traditional financial institutions are facing challenges. The challenges are due to the loss of talent necessary to maintain their heavily customized and poorly documented cores.

This combination of current conditions generally evens the playing field when it comes to technology-centric risk to consumer data.

Security Threats To Your Money Safe in the Cloud

With infrastructure security being comparatively equal at present, the biggest risk to your personal data and financial information is human behavior. Hackers who can’t gain access to infrastructure through technology exploit human behavior.

For instance, they will send emails to you or employees at the financial institution that look legitimate but contain a malicious link or attachment. A malicious link may direct you to a site that looks exactly like your banking site.

However, it is instead a page that mimics your institution’s page. It can collect your login credentials for the hacker to use to gain access to your real account.

Likewise, a malicious attachment can surreptitiously install malware on an employee’s machine. This would allow the hacker access from within the institutions’ infrastructure.

Investments In The Cloud

People are increasingly turning to the Internet to make investments these days. And that has the potential to be a positive development. After all, things like Forex Trading, cryptocurrency, and good old stocks and shares have the potential to be very lucrative and earn you some serious cash.

However, in some cases, this results in people being exposed to challenges and risks for which they are not entirely prepared.

Next, we will go over some of the techniques that you should use to safeguard your security and keep safe when you are investing your hard-earned money online.

So, continue reading to learn about the important information you should be aware of.

Do Your Research Before Putting Any Money In

First and foremost, you should include research as a critical component of your investment plan. The fact that you have not done a complete and comprehensive investigation on a form of investment before putting your money into it indicates that you are going about things incorrectly.

It is so easy to get caught up in the buzz and invest your money in something on the spur of the moment. Sometimes rash decisions can be profitable, but in the end, solid research always wins over.

If you are not sure, it is always wise to seek advice from an independent professional in the industry.

Consider Using a Virtual Private Network (VPN) for Money Safe in the Cloud

If you want to be as secure as possible, you must also be as hidden as possible and impossible to track down and identify. That is why, if you want to make money online, you must use a virtual private network.

The use of a VPN, or Virtual Private Network, can assist you to remain safe and secure while browsing the internet, regardless of where you are or what sort of device you are using.

So, if you have not already, make a point of implementing one of these technologies. This will protect you across the entire internet, not just when it comes to investments.

Learn The Signs of a Scam To Stay Safe Investing Your Cash Online

When it comes to investing money online, it is critical that you understand how to identify scams and avoid them. There are numerous ways in which individuals can defraud you of your hard-earned money if you are not careful.

Therefore, always be on the lookout and be aware of the most frequent scams that are out there.

This includes phishing scams and pyramid or Ponzi schemes. Again, plenty of thorough research and speaking to someone in the industry will help you identify these scams.

Bottom Line with Your Investments/Money Safe in the Cloud

The bottom line is that the technology infrastructure is not the biggest risk to the safety of your personal and financial information at your bank, regardless of whether it is traditional or next-generation.

To reduce your risk, make sure your financial institution has solid practices to control their employees’ behavior. Also, make sure you are personally well informed about malicious emails and don’t become a personal victim.

Before you even consider investing, you should double-check that all of the boxes on the checklist above have been checked and that you are fully equipped to take care of yourself in the virtual world.

Failure to do so would only cause you to suffer in the future and could result in you losing a significant amount of money if not all of it.

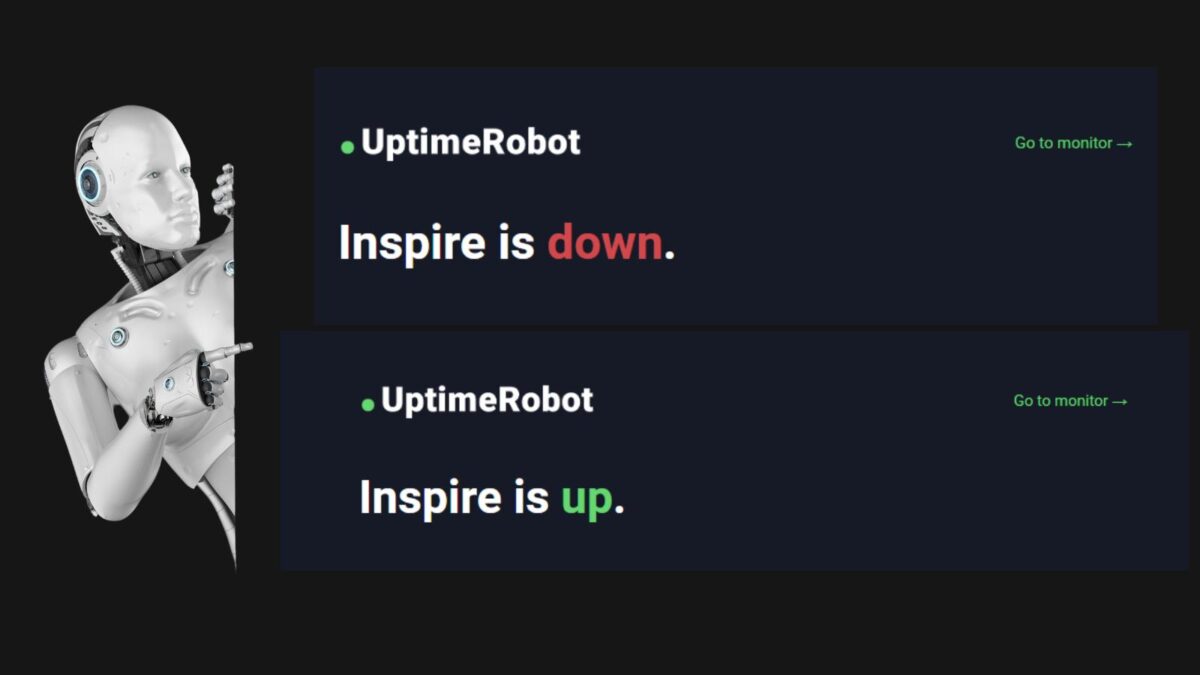

Does Your Website Run in the Cloud?

Why the cloud?

The major benefit cloud hosting offers over shared hosting is that it allows you to utilize the resources of multiple servers. This is superior rather than being limited to a single server.

With cloud hosting, you can monitor and allocate additional resources easily, allowing for unlimited expansion and growth.

I’d love to know more in the comments below if you worry about your money being safe in the cloud.

- Better Tips and Tricks for Growing Your Digital Marketing Firm - November 2, 2025

- Peekviewer (Formerly Glassagram) Review: Unlocking Instagram Insights for Business Growth and Family Safety - November 1, 2025

- How To Write Your Website Biography to Inspire Others to Thrive - October 30, 2025

Hey Lisa,

Rijhu this side.

This is really something that needs more concern. I really appreciate and like the way you put your blogs and help out your readers. Yes very well mentioned and I completely agree being disciplined as a user and how disciplined your financial organisations employees are matters a lot when it comes to safety and security.

Nowadays many of us are preferring mobile banking or internet banking and to reduce risk it is very important to be well informed about malicious emails and links as they look a like very similar to banking sites. Thanks Lisa and keep writing.

Regards,

Thank you Rijhu, You are most welcome. Banking online and in the cloud is safer today as long as you follow safety practices like locking your mobile device and keeping passwords safe!